Something very important has been proving and reinforcing the scarcity characteristics of bitcoin.

In addition to the recent news from institutional players becoming increasingly interested in bitcoin (more recently Paypal entering the cryptocurrency market once and for all), a specific metric can be particularly crucial for the price increase and be causing demand to far exceed any BTC offer available to buyers.

The number of bitcoins lost or not moved out of wallets exceeds the number of new bitcoins created daily, currently 900 BTC per day. This metric, if proven, can cause demand to far exceed the BTC supply available to buyers, causing a shock between supply and demand.

demand, further favoring the chances of appreciating the price of the first digital asset with programmed scarcity, which in just over 10 years has been able to prove its strength and its value.

Once all 21 million units have been extracted, no more units can be produced. It seems that this becomes more and more evident as time goes on that bitcoin keeps working.

Retail demand will continue to grow this year and in 2028 will be much higher than the emission.

This relationship points to a very big change in 2028, when the bitcoin supply rate drops even further and these retail addresses begin to consume all the new supply alone.

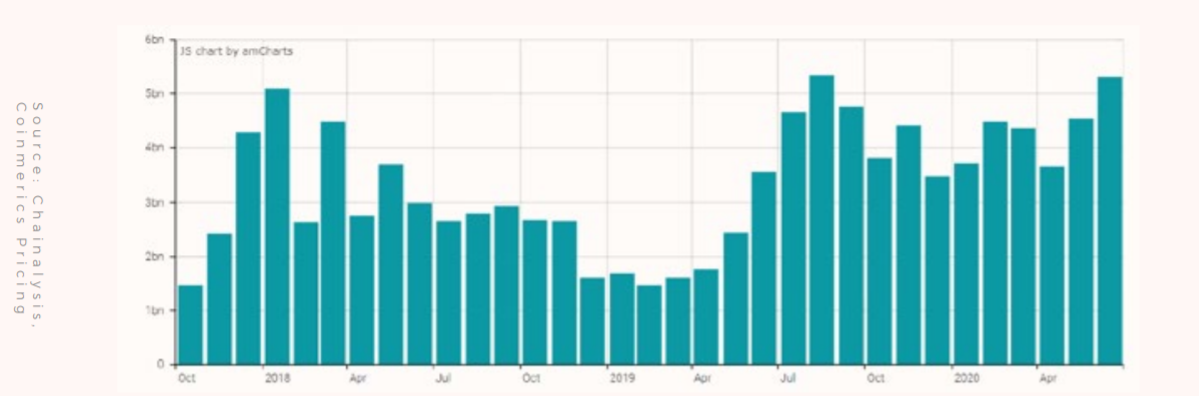

BITCOIN RETAIL DEMAND ESTIMATES VERSUS SUPPLY

The total value of addresses that do not move bitcoins reached the accumulated sum of US $ 5 billion in June this year. If that demand continues and grows, it will replace the amount of bitcoins extracted daily in 2028.

USD VALUE OF BITCOIN HOLDINGS IN ADDRESSES FROM EXACTLY 1 UP TO 10

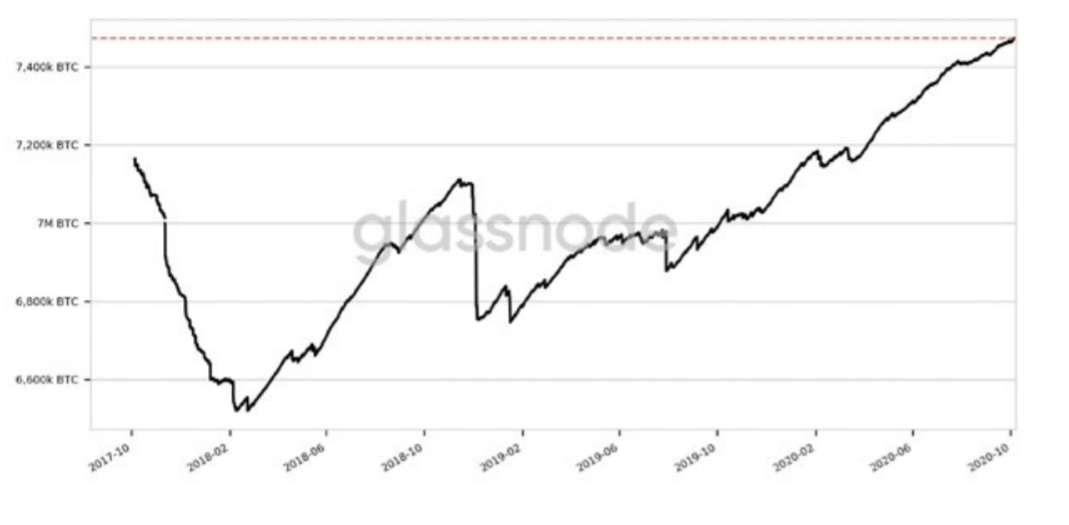

Recent estimates by Glassnode indicate that the amount of “lost” or “accumulated” BTC is increasing every day and that it currently stands at 1,375 BTC, resulting in the creation of new coins in circulation being exceeded by 475 BTC per day.

In total, it may be that there are currently almost 8 million bitcoins being saved or lost.

From the graph, it is possible to observe that this number has been constantly increasing and is at the highest levels to date.

BTC HODLED OR LOST COINS

Cane Island’s April estimate shows that approximately 1,500 bitcoins are lost daily and that only 14 million BTC are in circulation.

MORE THAN HALF OF THE BTC IN CIRCULATION HAS BEEN STOPPED FOR A YEAR OR MORE.

- More than 1 year ago: 63.3% ($ 11.7 million BTC).

- More than 2 years ago: 44.5% (8.2 million $ BTC).

- Over 3 years ago: 31.4% ($ 5.8 million BTC)

BITCOIN: PERCENT OF SUPPLY LAST ACTIVE 1+ YEARS AGO VS. BITCOIN: PERCENT OF SUPPLY LAST ACTIVE 2+ YEARS AGO VS. BITCOIN: PER.

In short, in addition to the coins being sold on exchanges – a number that decreases every day – only 900 BTC are being generated every day by miners and what we can see is that the amount of bitcoin coming out of the market is greater than that.

Therefore, we have a favorable scenario for the imbalance in the supply and demand relationship, which can prove the theory of price appreciation after halvings, as happened in previous events. In addition to this, another theory that can be proven is that of S2F.

The amount of bitcoin is decreasing more and more and this possible shift in supply and demand is very relevant.

This without taking into account all the economic variables that we are currently experiencing, such as the increase in the money supply due to fiscal stimulus on the part of central banks, which can be another crucial factor, serving as fuel for the next high.

Perhaps, not having a small percentage acquired can be expensive in the future, when bitcoin becomes even scarcer.

This article was first published on Voice and granted permission from Simplify Crypto.