We launched Roseon Finance to solve exactly one problem: decentralized finance (DeFi) offers users a good rate of return on their assets, but needs to be easier to use.

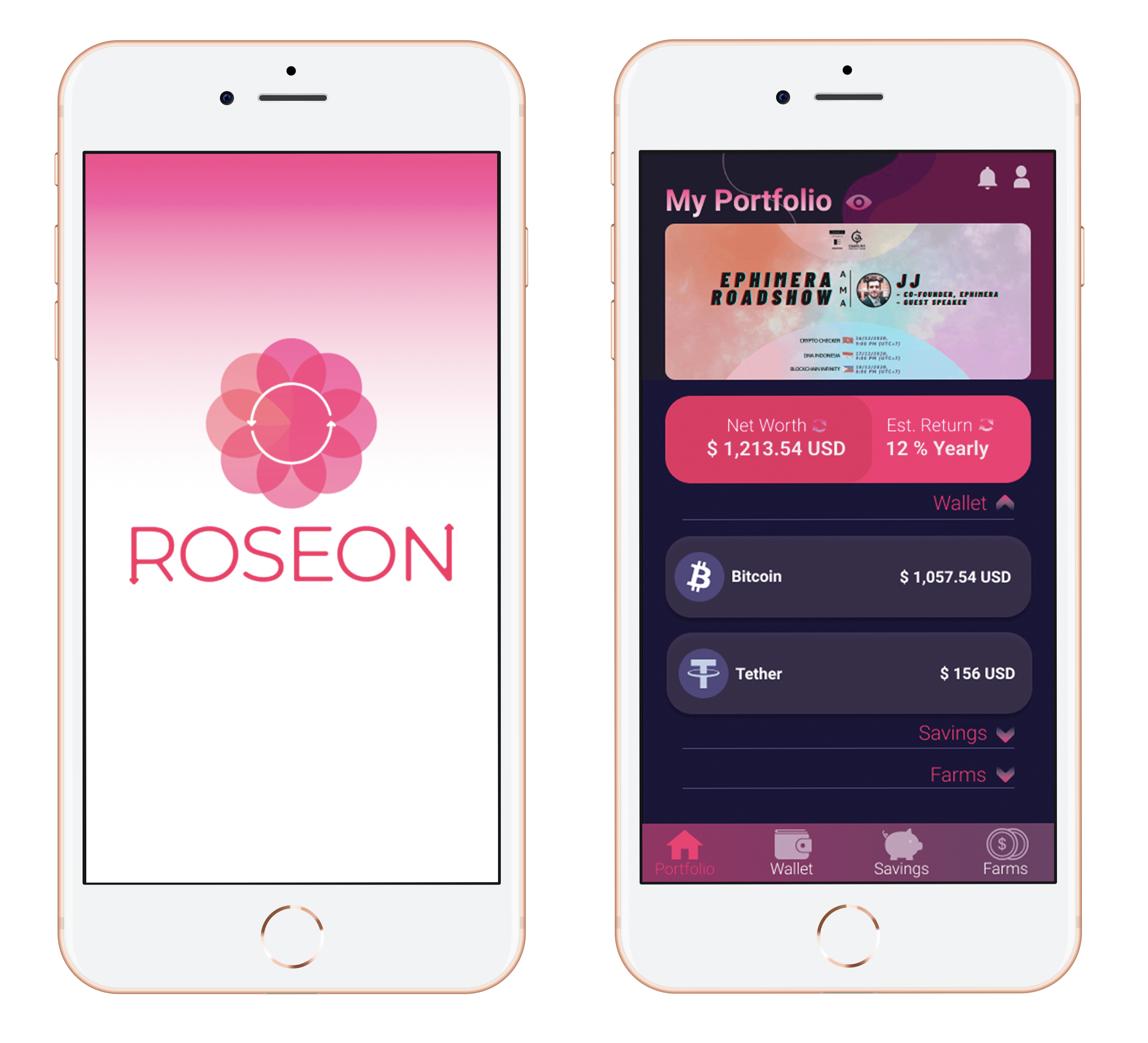

Our app offers a simple interface that lets you benefit from decentralized financial products without having to navigate through the maze of DeFi. Our first offering is USDT, ETH, and BTC term deposits. Our term deposits offer a fixed interest rate, fixed duration and ZERO FEES.

Through our partnerships of with a network of centralized and decentralized borrowers, we use an algorithm to maximize yield. In short, you earn a guaranteed interest rate, and we take on the risk and work — we make a profit by outperforming the rate we offer you.

You might ask why it makes sense to use a centralized wallet to handle decentralized financial products — this is a good question to ask. The short answer is that most people struggle with the core elements of cryptocurrency and decentralized finance — for example safely managing private keys and auditing smart contracts (for bugs, scams and so on).

A longer answer lies both in the history and complexity of decentralized finance.

A Brief History of Money

Money in various forms has been around for the last 5000 years or so. At first, it directly represented physical goods — for example a bushel of grain. Later, it could be directly exchanged for a fixed amount of some physical good. Finally, it held an abstract nominal value not tied to any single commodity. This final form of money in particular was easy to digitize, and evolved to become the digital money we use in our daily lives.

This form of money works well, but it does have a few problems — for example, if it’s not tied to particular good, how can you fairly create more of it? Presently this is done using a central bank, and a fractional reserve system at various smaller banks.

The central bank (through various mechanisms), adds or removes money from the smaller banks. These smaller banks are required to keep a fraction (say 10%) of all deposits, but can lend out the rest — much of which will end up as another bank deposit, 90% of which can be lent out again.

These iterative loans result in the creation of about 10x the money originally created by the central bank, and is a partially decentralized model involving the interaction between a central bank, smaller banks, a credit reporting agency, and a business or individual.

This all works very well, except that it has the unusual side effect of creating an economy where there is typically more debt than assets. This can become a problem when money is lent irresponsibly — when debtors default too often, too much of this unbacked debt gets called in at once, and we end up with a financial crisis (e.g. the subprime mortgage crisis in 2007–2010).

In response to this type of irresponsible behavior, Bitcoin was created. It had a fully decentralized model using blockchain — new Bitcoin was produced by solving shared cryptographic puzzles (“mining”), and all participants had the ability to send, receive, and process transactions without restriction. Once it caught on, thousands of cryptocurrencies were created.

The next key development was that blockchain could do more than just hold and transfer money. It should be able to hold and enforce contracts that control and automate the flow of money. Ethereum was the first to do this using the Ethereum Virtual Machine (EVM), allowing smart contracts to be written in a programming language and publicly stored in a blockchain.

It wasn’t long before someone thought of programming a smart contract that defines an investment — the beginning of DeFi.

The Birth of DeFi

When MakerDao launched in 2017, it was an open question whether decentralized blockchain assets could be made stable enough to allow the full range of financial services provided by traditional finance.

Shortly after, Ether skyrocketed to over USD 1000 each, and by the end of the year was trading around USD 80. Over the course of that period, DAI continued trading reasonably close to USD 1, as designed — proving that decentralized finance doesn’t have to go hand-in-hand with volatility.

Around the same time, Uniswap had been launched, and was starting to attract attention. Uniswap became by far the most efficient and popular decentralized asset exchange — it presently has around USD 3 billion in total value managed in it’s smart contract, and handles around USD 270 million in daily volume.

More importantly though, it introduced a concept called liquidity mining, or yield-farming. By staking your assets in a Uniswap smart contract, you are helping provide liquidity to traders that use it. In exchange for that service, Uniswap pays out a fee to you.

This concept where any person can provide a financial service, and receive a fee from users of that service is the core concept of decentralized finance. The concept took off in 2020 — likely in response to the COVID pandemic. Loss of employment, dropping interest rates due to government lending programs, and an uncertain economy all meant there was demand for a new source of passive income offering reasonable returns. This was especially appealing to younger audiences that had already heard of Bitcoin and Ethereum. Due to this high demand, many new projects have formed since Uniswap, reaching a high point in summer 2020.

What Goes Up, Must Come Down

Just like what we saw in the 2018 ICO bubble, some pretty wild promises of unsustainable profits were made at this point. Meanwhile, many investors didn’t really understand the underlying technology or mathematics that made Uniswap successful. The market crashed fairly hard, with about a 60% reduction in value by early November 2020.

The core service providers, like Uniswap and AAVE, weathered the downturn fairly well, just like MakerDao weathered the 2019 Ethereum crash. Here we saw an opportunity — if decentralized products based on sound financial principles could retain value through market crashes, then many cryptocurrency holders would benefit from a managed fund.

When you go to the bank, you don’t need to be a financial expert or a lawyer to invest your money, because for many types of investment, that’s the job of the bank. These fixed-rate investments mean you know what you’re putting in and what you’re getting out. We wanted to make cryptocurrency work like this too, by making fixed-rate term deposits our first product.

Finally, we take care of some of the less user-friendly aspects of cryptocurrency. You no longer have to worry about losing your funds due to misplacing a private key or sending it to the wrong smart contract address — we safely store your keys and take care of all DeFi transactions. There’s also no need to worry about bugs or scams hidden in DeFi smart contracts — we hire smart contract programmers to audit the code before we use them. We also provide a secure password reset service, so there’s no need to experience the pain of losing your funds when you lose your password.

Where does the money come from?

Anyone offering you a rate of return on investment should be able to tell you where the profit comes from. In our case, we use both centralized and decentralized finance to optimize profits. At the start, our algorithm uses both decentralized yield-farming and centralized margin-lending services — depending on what’s better at the time.

We only use well-established projects and exchanges. This is how we achieve a better rate than most users can achieve on their own. We also guarantee a particular rate of return for every term deposit with us, so our users know exactly what to expect and when.

Of course, we have plans to offer more than just fixed-term deposits. There are many decentralized financial products we want to simplify! Very soon, we plan to offer more passive strategies like index funds and yield-farming pools, as well as active strategies that consist of various managed funds.

Finally, we have some very exciting NFT (non-fungible token) strategies in our pipeline that we want to share with you soon.

Visit Roseon’s Webiste for more infomation.

You may also want to read: Fintech and DeFi in Asia: A Tool to Empower Women